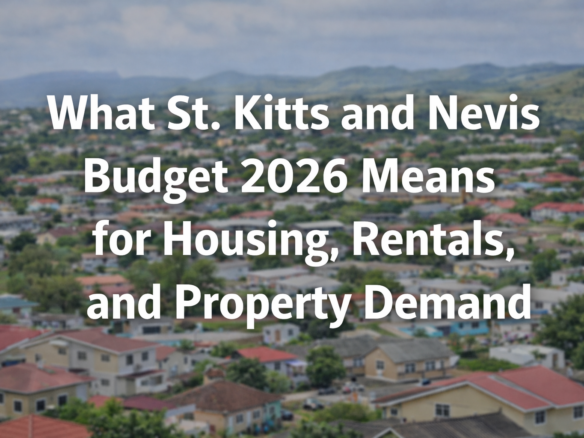

When someone in St. Kitts & Nevis passes away, their real estate and other assets become part of their estate and must be distributed under the law. If there is a valid will, the estate is handled under the Wills Act . If there is no will (intestate), the Intestates Estates Act applies. (There are no inheritance or estate taxes in St. Kitts and Nevis, which encourages people to make wills without fearing heavy tax bills.) In either case, the surviving family will need a grant from the court, either Probate (if there is a will) or Letters of Administration (if intestate), before property can be transferred or sold.

After a death, the High Court’s Probate Registry oversees the estate. The named executor in the will (or, if there is no will, an administrator) must file an application for a grant in the Supreme Court. Under the Probate Rules, the executor is given first priority to apply, followed by any residuary beneficiaries or next-in-line heirs. In intestate cases, the law sets a priority order: first the surviving spouse, then children and their descendants, then parents, siblings, grandparents, etc. In practice this means, for example, a widow or widower and the deceased’s children have the right to be appointed as administrators of an intestate estate.

With a Will (Probate Process)

With a Will (Probate Process)

If the deceased left a valid will, it must meet the formal requirements of St. Kitts and Nevis law. The will must be in writing, signed by the testator (at least 18 years old and of sound mind) in the presence of two witnesses, who also sign. (St. Kitts and Nevis rules follow the English common law model.) The executor named in the will then files for a Grant of Probate at the High Court, submitting the death certificate, the original will, an inventory of assets, and an affidavit proving the will’s execution. The court will check that the will is valid and that debts and taxes (if any) are accounted for. Once probate is granted, the executor has legal authority to collect the estate’s assets, pay debts and funeral expenses, and then distribute property according to the will.

Crucially, the will can distribute property as the testator wishes – even overriding what intestacy law would do. For example, under a will the deceased might leave all land to one child or direct that real estate be sold and the proceeds split. (Without a will, the reserved portions of the estate are fixed by law – see below.) Executors do have power to sell estate land if the will authorizes it, or if sale is needed to pay debts or distribute assets. In practice, to sell real estate the executor (or administrator) and all beneficiaries must sign the deed of sale. If the will grants the executor a power of sale, or if all beneficiaries agree, the property can be sold and the net proceeds shared. Otherwise, any heir who refuses to sign can delay the sale.

No Will (Intestate Succession)

If there is no will, the Intestates Estates Act governs distribution. First, the surviving spouse is entitled to a “reserved portion” of the estate (the law treats the spouse’s interest specially). All personal property of the deceased (cash, vehicles, goods, etc.) goes to the spouse. From the real estate and remainder, the spouse is guaranteed the greater of EC$5,000 or 10% of the net estate, and in all cases the spouse gets a life interest in at least half the property. Practically, this means:

- If there are no surviving children, the spouse receives a life interest in the entire estate.

- If there are children (born in or out of wedlock – all count equally), the spouse gets a life interest in half the estate and the children inherit the other half in equal shares.

After the spouse and children, the law provides a strict order of heirs: next come the deceased’s parents, then siblings (first of the whole blood, then half‑blood), then grandparents, then uncles and aunts, and so on. If no relatives can be found at all, the estate ultimately escheats to the Crown/Government. (In rare cases of very complex intestacy, an interested person could even end up applying for Letters of Administration de bonis non to deal with leftover assets, as seen in local court cases.)

To summarize: with no will, the High Court will usually appoint the spouse or a close relative as administrator of the estate. That administrator must then follow the Intestates Estates Act’s formula: pay debts, give the spouse their reserved share or life interest, then divide the rest among the children and other heirs.

Roles and Authority

In either case (with or without a will), the person who holds the grant (Probate or Letters of Administration) has the authority to deal with the estate property. The grant-holder is usually required to inventory all assets and debts, advertise for creditors, and eventually distribute the net estate. All heirs who receive property share legal ownership. For example, if land is inherited by several children, they will become tenants in common in that property unless the will says otherwise. Each owner then has an equal right to occupy or receive rent, and must agree (sign the transfer deed) if the land is to be sold. Only when the grant is in hand can the administrator or executor obtain a vesting order or re-registration so that title is held in the heirs’ names or in the name of the estate, allowing formal sale or transfer of title.

Selling Inherited Real Estate

Selling inherited land can be straightforward if all beneficiaries agree. The executor/administrator (once they have their grant) can sign a Deed of Sale on behalf of the estate, and the heirs simply join in the sale documents, sharing the proceeds as directed (by will or by law). However, family situations often complicate this: for example, one heir might want cash from a sale while another wishes to keep the property.

Here are some practical tips when multiple heirs are involved:

- Communicate Early: Gather all beneficiaries and discuss options openly. Decide together whether to keep, lease or sell the property.

- Get a Valuation: Know the market value. Hire a local real estate agent (like SKN Real Estate!) for a survey, so everyone has the same information.

- Consider Buy-Outs: If some heirs want to sell and others don’t, the ones staying can offer to buy out the others’ shares at fair value. This can be easier than dividing up land.

- Put Agreements in Writing: If everyone agrees on a solution (e.g. who sells, who pays who), document it. A simple deed or memorandum signed by all heirs can prevent later disputes.

- Use Professional Help: An attorney or mediator can clarify the legal shares and help resolve disagreements. They can also ensure formal steps (grant, title transfer, sale contract) are done correctly.

If no agreement can be reached, legal remedies exist. Although St. Kitts & Nevis law has no specific Partition Act, the High Court can sometimes order a sale of the property in equity (so the asset is sold and proceeds divided) if the beneficiaries are deadlocked. In practice, one heir could petition the court to force a sale or appoint an independent administrator to handle it. (Court rules also allow removal of any unfounded caveats on the title, and grant Letters of Administration even if heirs have disputes.) The key is that, ultimately, the court can step in to break a tie.

One more practical point: foreign heirs have an extra requirement. If someone who is not already licensed in St. Kitts and Nevis (an “alien” under local law) inherits land, they must either obtain a local landholding licence or sell the property within one year. Otherwise the government could take the land. This is a strict rule under the Aliens Landholding Regulations. So foreign relatives who inherit must act promptly on this requirement.

Avoiding Confusion and Conflict

Avoiding Confusion and Conflict

To avoid family rifts and confusion after a death, it’s best to plan before a person passes or else handle matters transparently afterwards. Making a clear, up-to-date will is the first step – it lets everyone know who gets what. If no will exists, affected family members should at least keep the lines of communication open. Here are some strategies for smooth handling:

- Document Wishes: Even if there’s no formal will, a deceased person can leave a letter of instruction or list of contacts. This makes it easier to locate heirs.

- Involve a Neutral Professional: Ask a lawyer or SKN Real Estate agent to explain the process impartially. Their advice can reduce misunderstandings.

- Decide on an Administrator Together: All close heirs should agree on who manages the estate. If no one is chosen, anyone with a claim (spouse, child, parent, etc.) can apply for Letters of Administration.

- Schedule Family Meetings: Work out a plan for handling the property soon after the probate grant. Uncertainty can breed conflict, so early cooperation is key.

- Consider Leasing: If sale is delayed, renting the property (with all owners’ approval) can cover upkeep and taxes, preventing the property from falling into disrepair.

The goal is to reach an arrangement that everyone accepts. When family members cooperate—agreeing on a sale price, signing necessary documents, and splitting proceeds—it spares time, cost and heartache. If tensions do arise, legal guidance can help keep the process orderly.

Preventing Abandonment

Preventing Abandonment

An unfortunately common problem is abandoned property: heirs who neglect an inherited house or land. To avoid this, someone should ensure the property is maintained and taxes paid. Otherwise, the property’s value will decline or it might even be forfeited by the Crown after many years. Remember, under St. Kitts and Nevis law if nobody claims or maintains the estate, in time the land can escheat to the government. Even if heirs can’t all agree on what to do immediately, they should at least file for Letters of Administration and take steps to secure the land title. That way, they preserve options: they can rent it out or get clear title while long-term decisions (sell or keep) are worked out.

In short, communication and prompt action are the antidotes to abandonment. Keep all beneficiaries informed, hold joint meetings, and get professional advice so the property doesn’t slip through the cracks.

St. Kitts & Nevis law provides clear rules for inheritance, whether there is a will or not. With a will, the named executor handles the estate under the Wills Act. Without a will, the Intestates Estates Act spells out the shares (spouse, children, etc.). In all cases, estate property must pass through the court’s probate system (Grant of Probate or Letters of Administration) before the land can be sold or transferred. Selling real estate involves getting all legal owners on board or resorting to court measures if there is disagreement.

For families facing these issues: start by obtaining legal advice and communicating openly. Remember that St. Kitts and Nevis does not levy inheritance taxes, but it does demand a quick resolution for foreign owners (license or sell within one year). Keeping everyone on the same page – through clear wills, honest talks, and written agreements – is the best way to avoid confusion and disputes. And if conflicts do arise, the Supreme Court and estate laws provide mechanisms (like Letters of Administration and court-ordered sales) to reach a solution.

Every inheritance situation is unique, so expert guidance can be invaluable. If you’re dealing with property after a loved one’s death in St. Kitts & Nevis, consider reaching out to SKN Real Estate. Our local team can explain the probate process, help coordinate with lawyers, and assist in marketing or valuing inherited property. We’re here to make the process as clear and smooth as possible during a difficult time.

For help with wills, probate, and selling inherited real estate, contact SKN Real Estate today and get the experienced guidance you need.

Sources: St. Kitts and Nevis Wills Act and Intestate Estates Act (Revised Laws of St. Christopher & Nevis) and Eastern Caribbean Supreme Court Probate Rules.