Welcome to the insider’s guide to finding bargains in St. Kitts! If you’re in the market for a new home and looking for unbeatable deals, you’ve come to the right place. This article will unveil the secrets of foreclosure homes in St. Kitts, giving you the inside scoop on how to find your dream property at a fraction of the cost.

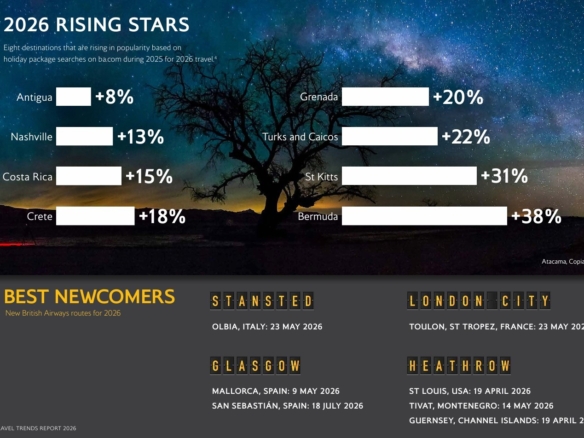

St. Kitts, a Caribbean paradise, is renowned for its stunning beaches, crystal-clear waters, and vibrant culture. And now, with the rise of foreclosure homes on the market, it’s becoming a hot spot for savvy investors and homebuyers on a budget. Whether you’re looking for a beachfront villa, a cozy cottage, or a spacious family home, there are incredible deals waiting to be discovered.

In this guide, we’ll walk you through the process of finding and purchasing foreclosure homes in St. Kitts. From understanding the foreclosure process to searching for listings and negotiating the best price, we’ll provide you with all the insider knowledge you need to score a fantastic deal.

So, get ready to embark on your journey to affordable homeownership in St. Kitts. Let’s dive in and uncover the hidden gems of foreclosure homes together!

Understanding the foreclosure process in St. Kitts

Foreclosure homes offer a range of benefits for homebuyers in St. Kitts. Firstly, they are often sold at significantly discounted prices compared to the market value. This presents an excellent opportunity to purchase a property at a fraction of its actual worth. Secondly, foreclosure homes provide a chance to invest in prime locations that may have been otherwise unaffordable. With beachfront and ocean-view properties available, you can live in your dream location without breaking the bank.

Additionally, buying a foreclosure home allows you to customize and renovate the property to your liking. This is especially appealing for buyers who enjoy DIY projects and want to add their personal touch to their new home. Lastly, foreclosure homes can be a profitable investment. If the property is well-maintained and the market conditions are favorable, you have the potential to make a significant profit by selling the property in the future.

Researching foreclosure listings in St. Kitts

Before diving into the world of foreclosure homes in St. Kitts, it’s crucial to understand the foreclosure process. In St. Kitts, foreclosure typically occurs when a homeowner fails to make their mortgage payments for an extended period. The lender then initiates legal proceedings to repossess the property and sell it to recover the outstanding balance.

The foreclosure process in St. Kitts consists of several stages, including pre-foreclosure, auction, and bank-owned properties. During the pre-foreclosure stage, the property is still owned by the homeowner, but they are in default on their mortgage. This is an excellent opportunity for buyers to negotiate directly with the homeowner and potentially avoid the auction process.

If the property goes to auction, interested buyers can bid on the property. The highest bidder wins the property, but it’s essential to be prepared as auctions can be competitive. Finally, if the property does not sell at auction, it becomes a bank-owned property. These properties are typically listed with real estate agents and sold through traditional channels.

Evaluating the condition of foreclosure homes

To find foreclosure homes in St. Kitts, thorough research is essential. Start by checking local newspapers, online classifieds, and real estate agencies like SKN Real Estate for foreclosure listings. Some websites specialize in listing foreclosed properties, making it easier to find a wide range of options in one place. It’s also worth reaching out to local real estate agents SKN Real Estate who specialize in foreclosure properties, as they often have exclusive listings and can provide valuable insights.

When researching foreclosure listings, pay attention to important details such as the property’s location, size, condition, and asking price. Take note of any additional costs or fees associated with the purchase, such as taxes or repairs. It’s crucial to obtain as much information as possible to make an informed decision and avoid any surprises down the line.

Financing options for buying foreclosure homes

One of the critical aspects of buying a foreclosure home is evaluating its condition. As these properties are often sold “as-is,” it’s essential to thoroughly inspect the property for any potential issues or repairs needed. Consider hiring a professional home inspector who can identify hidden problems such as structural issues, plumbing or electrical problems, and water damage.

Keep in mind that foreclosure homes may have been vacant for an extended period, leading to neglect or lack of maintenance. Ensure you factor in the cost of repairs and renovations when determining the overall value of the property. It’s also important to set realistic expectations and be prepared for unexpected surprises that may arise during the renovation process.

Tips for negotiating the purchase of a foreclosure home

When it comes to financing the purchase of a foreclosure home in St. Kitts, there are several options available. Traditional mortgage lenders may be hesitant to finance foreclosure properties due to their condition or unique circumstances. However, there are specialized lenders who cater to buyers interested in purchasing foreclosure homes.

An alternative financing option is to consider a renovation loan, which combines the purchase price of the property with the cost of renovations. This type of loan allows buyers to finance the repairs and improvements needed to bring the property up to standard. It’s essential to explore different financing options and consult with a mortgage specialist to determine the best solution for your specific situation.

Potential risks and challenges of buying foreclosure homes

Negotiating the purchase of a foreclosure home can be a unique experience. Here are some tips to help you navigate the negotiation process and secure the best deal:

1. Research the property’s market value: Before making an offer, research the market value of similar properties in the area to ensure you’re offering a fair price.

2. Be prepared for competition: Foreclosure homes can attract multiple buyers, so be prepared for potential bidding wars. Set a budget and stick to it to avoid overpaying.

3. Work with a real estate agent: A knowledgeable real estate agent specializing in foreclosure properties can provide invaluable advice and assistance throughout the negotiation process.

4. Consider cash offers: Cash offers can be appealing to sellers, as they provide a quick and hassle-free transaction. If possible, consider making a cash offer to increase your chances of success.

5. Be patient and persistent: The negotiation process for foreclosure homes can be lengthy and complex. Stay patient and persistent, and don’t be afraid to walk away if the deal doesn’t meet your expectations.

Working with a real estate agent specializing in foreclosure homes

While buying a foreclosure home can be a great opportunity, it’s essential to be aware of the potential risks and challenges involved. Some common risks include hidden liens or debts on the property, property damage or vandalism, and legal complications. It’s crucial to conduct thorough due diligence and work with professionals such as real estate agents, attorneys, and home inspectors to mitigate these risks.

Another challenge to consider is the competition from other buyers. Foreclosure properties often attract a significant amount of interest, particularly if they are located in desirable areas or offered at exceptionally low prices. Being prepared, proactive, and flexible can help increase your chances of securing a foreclosure home.

The potential for finding bargains in St. Kitts foreclosure homes

Navigating the world of foreclosure homes can be complex, which is why working with a real estate agent specializing in this area can be highly beneficial. These agents have in-depth knowledge of the foreclosure process and can provide guidance and support throughout your homebuying journey.

A specialized real estate agent can help you find the best foreclosure homes that match your criteria, negotiate on your behalf, and ensure a smooth transaction. They can also provide insights into the local market, assist with property inspections, and recommend reputable professionals such as home inspectors and contractors.